Infinity Globus

Infinity Globus

14 May 2025

14 May 2025

In today’s dynamic accounting world, CPA and accounting firms are under constant pressure to deliver high-quality audit services while also managing workforce constraints, shifting client demands, and evolving compliance standards. Outsourcing audit services has quickly become more than a stopgap solution—it’s now a strategic lever for CPA firms aiming to stay nimble, efficient, and competitive.

This blog breaks down how outsourcing audit functions can become a core part of your firm’s agility strategy, reducing costs, increasing access to talent, improving turnaround times, and future-proofing your operations.

The changing face of auditing: Why agility is non-negotiable

Audit season can be chaotic. With tighter deadlines, heightened client expectations, and growing regulatory scrutiny, CPA firms often struggle and find it hard to balance workloads without burning out their teams or compromising quality.

Here’s what modern accounting firms are up against:

- Talent shortages in the U.S. accounting sector

- Rising audit complexity due to international regulations and cross-border operations

- Budget pressures and demand for value-driven pricing models

- The rapid pace of tech disruption in audit methodologies

To thrive in this environment, firms need the ability to scale quickly, access specialized skills on demand, and streamline delivery without sacrificing quality. That’s where outsourced audit services come into play.

8 strategic ways outsourced audit services promote agility and growth for CPA firms

Outsourcing isn’t just about savings—see how it drives performance and client value for CPA firms.

1. Enables dynamic audit resource scaling

Outsourced audit services empower CPA firms to adjust audit team sizes swiftly in response to seasonal audit demands or specific engagement needs. This flexibility allows firms to:

- Rapidly onboard seasoned audit professionals for peak periods, such as year-end or tax season.

- Eliminate excess staffing costs during quieter periods.

- Reallocate audit personnel across engagements seamlessly, bypassing traditional hiring delays.

2. Delivers cost-effective audit execution

By outsourcing repetitive audit tasks, such as data collection or preliminary testing, to specialized remote teams, CPA firms can reduce expenses while upholding rigorous audit quality. Benefits include:

- Lower costs by avoiding expenses related to hiring, training, and maintaining in-house audit staff.

- Transform fixed labour costs into variable, engagement-based expenses.

- Redirect savings to fund audit technology upgrades or firm expansion.

3. Provides access to deep industry and regulatory expertise

Outsourced audit providers employ professionals with deep knowledge of U.S. GAAP, IFRS, PCAOB standards, and industry-specific regulations, enhancing audit quality. They enable CPA firms to:

- Strengthen compliance with complex audit standards, reducing the risk of inefficiencies or penalties.

- Expand service offerings to niche industries (e.g., healthcare, manufacturing) or multinational clients requiring IFRS expertise.

- Minimize errors through access to auditors skilled in regulatory nuances and emerging standards.

4. Accelerates audit timelines

By utilizing global audit teams across time zones, outsourced audit services enable continuous workflows, significantly shortening audit cycles for accounting firms. This results in:

- Faster completion of audit procedures, such as confirmations, reconciliations, and sampling.

- Timely delivery of audit reports, meeting client deadlines without overburdening in-house teams.

- Enhanced client satisfaction through timely, high-quality audit deliverables.

5. Boosts in-house team productivity, retention, and audit continuity

Outsourcing repetitive audit tasks, such as data entry or control testing, frees internal teams to focus on high-value, strategic activities, improving morale and retention. Benefits include:

- Empowering in-house auditors to focus on strategic areas like risk assessments, client advisory, and audit planning.

- Reducing burnout by offloading time-consuming, repetitive tasks to external teams.

- Attracting and retaining top audit talent by offering more meaningful, skill-driven roles.

- Ensuring uninterrupted audit delivery through access to diversified, global audit teams.

- Mitigating risks from regional talent shortages or crises with reduced reliance on local resources.

- Supporting robust business continuity planning and maintaining audit quality during regulatory or operational disruptions.

6. Strengthens client relationships through audit insights

With routine audit tasks outsourced, CPA firms can dedicate more time to delivering actionable insights and strategic advice, positioning themselves as trusted partners. This enables:

- Proactive identification of client risks, operational inefficiencies, or compliance gaps during audits.

- Enhanced client engagement through tailored recommendations that drive business value beyond compliance.

- Stronger, long-term client relationships built on trust and demonstrated expertise.

7. Provides access to advanced audit technologies without heavy investment

Top outsourced service providers already use leading platforms like CaseWare, and CCH, allowing CPA firms to leverage new technologies without upfront investment. This facilitates:

- Automation of audit processes, including sampling, workpaper preparation, and substantive testing.

- Access to AI-driven analytics for deeper insights into client financials and risk areas.

- Seamless adoption of technology to enhance audit precision and efficiency.

8. Drives audit profitability and scalability

By optimizing resource allocation and reducing overhead, outsourced audit services enable CPA firms to expand capacity and profitability. Key advantages include:

- Increased audit engagement capacity without proportional increases in fixed costs.

- Higher realization rates through efficient audit workflows and maximized partner billable hours.

- Confident expansion into new audit markets, such as nonprofit or international clients, with scalable support.

Infinity Globus empowers CPA firms with the right mix of talent, technology, and timing. Contact us now to know how we can complement your internal team.

What audit tasks can be outsourced?

Outsourcing isn’t just about cost-cutting—it’s about strategic delegation. Many CPA firms are already outsourcing these core audit tasks:

- Audit planning support and checklist preparation

- Substantive testing and sample selection

- Bank reconciliations and third-party confirmations

- Inventory verification support

- Internal control documentation and walkthroughs

- Audit documentation standardization for peer review

By outsourcing these tasks, firms can not only streamline their operations but also focus on more value-added activities. This leads us to another important distinction in the audit process—understanding the roles and differences between internal and external audits.

Internal audit vs external audit: Key differences

Top 6 benefits of outsourcing audit services for CPA firms

1. Access to global talent

- Leverage skilled professionals from global markets to address U.S. talent shortages.

2. Cost efficiency

- Reduce operational costs by outsourcing routine audit tasks to remote teams.

3. Scalability and flexibility

- Seamlessly scale audit support during peak seasons without the burden of permanent hires.

4. Access to advanced technology

- Benefit from the latest audit tools and platforms used by outsourcing partners without large tech investments.

5. Enhanced focus on core activities

- Allow internal teams to focus on client strategy, advisory, and business growth while external teams handle execution.

6. Improved compliance and risk management

- Stay updated with changing audit regulations and standards through partners who specialize in compliance-driven audits.

How to successfully outsource audit tasks?

A. Phase 1: Strategic partner selection

- Vet providers for domain expertise, U.S. audit knowledge, and data security compliance (SOC 2, ISO 27001)

- Look for scalability, tech integration ability, and transparent communication

B) Phase 2: Workflow integration

- Use cloud-based audit platforms like CaseWare, CCH ProSystem fx, or AdvanceFlow to collaborate seamlessly

- Define workflows, deadlines, and escalation metrics clearly

C) Phase 3: Quality control and compliance

- Create standard audit documentation protocols

- Implement internal review checkpoints and sampling verification processes

D) Phase 4: Continuous optimization

- Measure KPIs like turnaround time, accuracy, and rework rate

- Solicit feedback from internal teams and external clients to fine-tune operations

Thinking about outsourcing but unsure where to begin? Infinity Globus can help you plan and execute a seamless transition. Contact us now!

Factors to consider before outsourcing audit functions

Outsourcing audit functions can bring many advantages, but there are several factors to evaluate before making this decision to ensure a smooth and effective partnership.

1. Understand the nature of your audit needs

- Define the scope and complexity of the audits.

- Determine if your audits are routine or specialized (e.g., financial, operational, compliance).

- Assess if you need an in-house team for complex audits or if outsourcing works for your needs.

2. Choose the right outsourcing partner

- Look for providers with experience in U.S. GAAP, IFRS, and industry-specific standards.

- Evaluate their experience with similar clients or industries.

- Verify certifications and adherence to professional audit standards.

3. Assess security and confidentiality protocols

- Ensure the provider has strong data security protocols.

- Look for certifications such as SOC 2 or ISO 27001 for data protection.

- Make sure they comply with privacy regulations.

4. Cost vs. quality considerations

- Consider the cost savings of outsourcing but balance it with the quality of service.

- Evaluate the provider’s value, experience, and reputation over just the lowest price.

- Ensure pricing models are clear and has no hidden fees.

5. Integration with Your In-House Team

- Ensure seamless communication and collaboration between in-house and outsourced teams.

- Set up clear workflows and touchpoints for regular check-ins.

- Evaluate whether your in-house team is comfortable with external collaboration.

6. Regulatory compliance and quality control

- Confirm the provider is up-to-date with the latest regulatory changes.

- Ask about their quality control processes to maintain high standards.

- Ensure they meet all required legal and industry standards for audits.

7. Turnaround time and service level expectations

- Set clear deadlines for audit completion.

- Ensure the provider can handle tight timelines, especially during busy seasons.

- Discuss escalation procedures if deadlines are missed.

8. Scalability and flexibility

- Ensure the remote service provider can scale resources up or down based on your audit needs.

- Look for a partner with flexible pricing models to match your workload fluctuations.

- Confirm that they can support long-term growth and changing audit requirements.

Every CPA firm is different—Infinity Globus offers customized audit outsourcing services to match your firm’s goals. Contact our audit experts today to get started.

Outsourcing audits: How to select the right service provider for your CPA firm

1. Assess their audit expertise

- Ensure the provider has experience with U.S. audit standards

- Look for industry-specific knowledge (e.g., healthcare, manufacturing, nonprofits).

- Ask about their track record supporting other CPA firms and audit practices.

2. Verify certifications and compliance

- Confirm data security certifications (SOC 2, ISO 27001).

- Ensure the provider complies with ethical audit standards and confidentiality protocols.

- Review their internal quality assurance processes.

3. Evaluate talent and team composition

- Check the qualifications of their auditors (e.g., CPAs, CAs, ACCAs).

- Ensure team members have hands-on experience with audit software like CaseWare, CCH, AdvanceFlow, etc.

- Evaluate their capacity to provide dedicated teams versus rotating resources.

4. Test technological compatibility

- Make sure their systems integrate with your existing platforms.

- Ask about their use of automation, audit analytics, and cloud-based documentation tools.

- Evaluate cybersecurity measures and document-sharing protocols.

5. Review turnaround time and workflow process

- Ask how they handle tight deadlines and high-volume periods (e.g., tax season).

- Review their standard operating procedures (SOPs) for workflow handoffs.

- Request SLA (Service Level Agreement) details for timelines and quality benchmarks.

6. Understand communication protocols

- Check their communication style, availability, and responsiveness.

- Prefer providers who offer U.S.-aligned time zones or 24/7 support coverage.

- Clarify escalation channels and frequency of check-ins.

Audit outsourcing common pricing models

When evaluating outsourcing partners, understanding different pricing models is essential for selecting the approach that best aligns with your firm’s objectives and engagement patterns. Below are the common pricing models used in this domain:

1. Hourly rate model

In this model, clients are billed based on the number of hours worked by external audit professionals.

- Best for: Projects with uncertain scope or variable workloads.

- Pros: Flexible; easy to scale up/down.

- Cons: Harder to predict total cost.

2. Fixed fee / Project-based pricing

This model includes a flat fee, agreed upon for a clearly defined scope of work.

- Best for: One-time or recurring projects with well-defined deliverables.

- Pros: Predictable cost; low risk of overrun.

- Cons: Limited flexibility if scope changes.

3. FTE (Full-time equivalent) / Dedicated team model

A set number of full-time personnel are assigned to the client and charged monthly in FTE model.

- Best for: Ongoing, long-term support needs.

- Pros: Strong alignment with client teams; consistency.

- Cons: Higher commitment; less flexibility for short-term changes.

4. Transaction-based pricing

In this, fees are based on the number of transactions or outputs processed (e.g., number of audit confirmations, reconciliations).

- Best for: High-volume, repeatable tasks.

- Pros: Scalable and measurable.

- Cons: Not ideal for complex or judgment-based work.

5. Hybrid model

Hybrid model combines two or more models (e.g., fixed base fee + per-transaction charge).

- Best for: Large contracts with varied services (e.g., planning, testing, documentation).

- Pros: Balanced approach; customizable.

- Cons: More complex to manage and monitor.

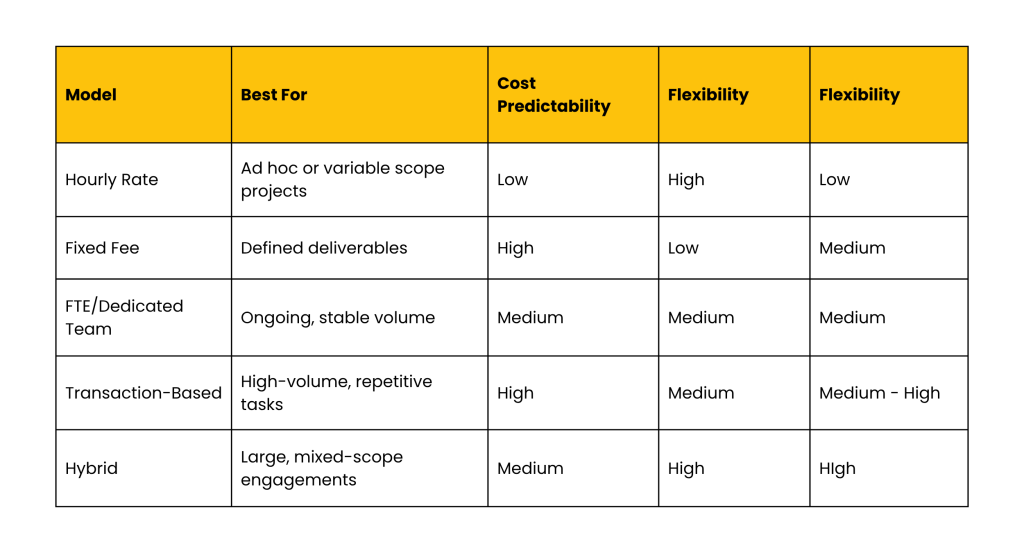

Pricing comparison table- At a glance

Conclusion

In an era where agility, compliance, and efficiency are non-negotiable, outsourcing audit services isn’t just a cost-saving tactic—it’s a competitive advantage. CPA firms that leverage outsourced audit functions can scale with demand, access top-tier audit expertise, boost profitability, and free up internal teams to focus on value-driven client relationships. As the audit segment continues to evolve, firms that adopt strategic outsourcing will be better positioned to deliver high-quality audits, manage growing complexities, and thrive in a dynamic marketplace.

Ready to scale smarter?

Partner with Infinity Globus for reliable, secure, and expert-led audit outsourcing. Contact us now!

FAQs

1. Why should CPA firms consider outsourcing audit services?

Outsourcing helps CPA firms manage resource constraints, scale operations during peak seasons, reduce overhead costs, and access specialized audit expertise. It’s a strategic move that enhances agility, improves service delivery, and helps firms stay competitive in a rapidly evolving industry.

2. How does outsourcing audit services help with talent shortages?

Outsourcing gives firms immediate access to a global pool of qualified professionals, including CPAs, CAs, and ACCAs. This is particularly valuable during staffing shortages or seasonal spikes in workload, reducing the pressure on internal teams.

3. How secure is it to outsource audit processes?

Reputable outsourcing firms follow stringent data security standards like SOC 2 and hold ISO 2700 certification. Always evaluate a provider’s security certifications and confidentiality protocols before engagement.

4. How does outsourcing contribute to profitability?

Outsourcing reduces fixed staffing costs, improves efficiency, and increases your firm’s capacity to handle more engagements without proportional increases in overhead, boosting realization rates and margins.

5. Can outsourcing audit functions improve client relationships?

Absolutely. By offloading time-consuming tasks, your internal team can focus more on advisory work, strategic insights, and building stronger client partnerships, transforming your firm from a compliance vendor to a trusted advisor.

6. Is it better to start small when outsourcing audit services?

Yes. Many CPA firms start with a pilot project to evaluate quality, turnaround time, and communication. It helps reduce risk and provides insight into whether a long-term partnership would be beneficial.

7. Can Infinity Globus scale audit support quickly during peak seasons?

Yes. Infinity Globus maintains a ready bench of experienced audit professionals who can be deployed rapidly during audit season or for large engagements. Our scalable delivery model ensures CPA firms can expand or contract resources on demand without the delays or costs of full-time hiring.

8. How does Infinity Globus maintain confidentiality and data security for audit files?

Infinity Globus is SOC 2 and ISO 27001 certified, with strict internal controls around access management, encryption, secure data transfer, and audit trail logging. Our secure work environments and compliance-driven culture make us a reliable partner for managing sensitive client financials and audit documentation.