Infinity Globus

Infinity Globus

5 Jun 2023

5 Jun 2023

In today’s rapidly changing world, crises and uncertainties are inevitable. Whether it’s a natural disaster, a financial downturn, or a cyber attack, it’s important to be prepared for anything.

As a CPA firm, it is essential to proactively build resilience and safeguard your firm amid crises.

This article will explore effective strategies and practical steps to help overcome challenges for CPA firms and ensure stability and success.

By building resilience in your business, you can protect your clients and team members.

1. Conduct a Risk Assessment

Before you develop a resilience plan, it is essential to identify the potential risks and vulnerabilities your CPA firm may face. To do this, you need to conduct a comprehensive risk assessment. This involves evaluating both internal and external factors that could impact your business operations.

Some of the internal factors you should consider include:

• Your firm’s financial health

• Your staff’s skills and experience

• Your firm’s technology infrastructure

• Your firm’s compliance with regulations

Some of the external factors you should consider include:

• The state of the economy

• Changes in regulations

• Natural disasters

• Cybersecurity threats

By understanding the risks, you can proactively prepare for them. This will help you to mitigate the impact of any challenges that your CPA firm may face.

2. Diversify Your Client Portfolio

Depending heavily on a few major clients can make your CPA firm vulnerable during crises. If one of these clients encounters financial difficulties, your firm could be severely impacted. By diversifying your client portfolio, you can distribute the risks and reduce your dependency on a single source of earnings.

You can do the following to diversify your client portfolio:

- Develop targeted marketing strategies: Identify industries and sectors that are growing and that are a right fit for your firm’s services. Then, develop marketing strategies that will reach these prospects.

- Attend industry events: This is a great way to network with potential clients and explore new opportunities.

- Partner with other CPA firms: This will help you reach a wider audience and offer a broader range of services.

By diversifying your client portfolio, you can reduce your risk and safeguard your CPA firm amidst crises.

3. Implement Robust Business Continuity Plans (BCP)

A business continuity plan (BCP) is a document that outlines how your CPA firm will continue to function during and after the crisis. It outlines specific steps to be taken in different scenarios, such as remote work arrangements, communication protocols, and data backup strategies.

A well-crafted BCP can help your firm to minimize the impact of a crisis and ensure that you can continue to provide essential services to your clients. However, CPA firms should regularly review and update these plans to ensure that they remain relevant and effective in the prevalent circumstances.

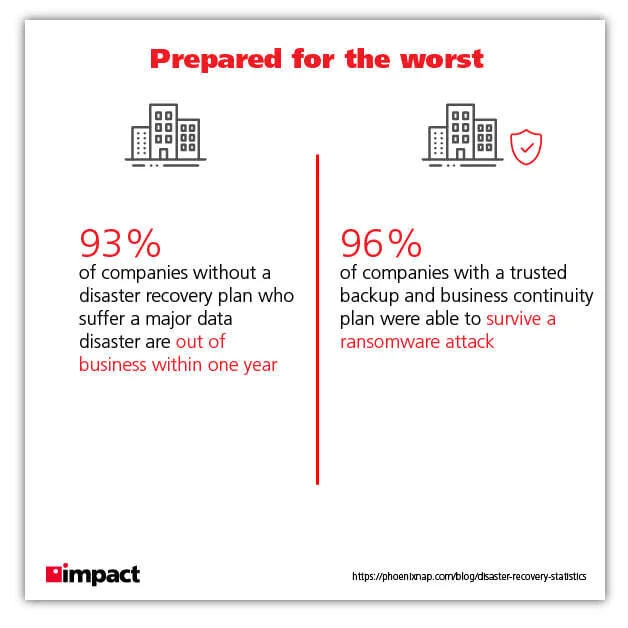

As mentioned by phoenixNAP, 93% of companies without Disaster Recovery who suffer a major data disaster are out of business within one year. While on the other hand, 96% of companies with a trusted backup and disaster recovery plan were able to survive ransomware attacks.

4. Leverage Technology for Remote Work

The recent global pandemic has shown that remote work is a feasible choice for CPA firms. By investing in robust technology infrastructure, CPA firms can facilitate their teams to work seamlessly from any location. This includes cloud-based accounting software, collaboration tools, and secure remote access to the client’s server.

Here are some of the benefits of leveraging technology for remote work:

- Increased productivity: Employees who can work from home are often more productive than those who are required to come into the office. This is because they can work in a distraction-free environment and set their productive hours.

- Reduced costs: Remote work can help CPA firms to lower their overhead costs. This is because they do not have to spend on office space or utilities for employees who are working from home.

- Improved employee morale: Employees who can work from home are often happier and more engaged in their work. This is because these employees have more flexibility and control over their work-life balance.

As mentioned in Statista, 80 percent of respondents from a global survey of employees working at least partially remotely would recommend the working arrangement to a friend.

Here are some of the technologies that CPA firms can use to support remote work:

- Cloud-based accounting software: Cloud-based accounting software allows CPA firms to access their data from anywhere. This makes it easy for its staff to share information.

- Collaboration tools: Collaboration tools, such as video conferencing and instant messaging, allow CPA firms to communicate with each other and with clients in real-time. This helps to keep everyone connected and on the same page.

- Secure remote access to client data: By using a VPN or encrypting the data, CPA firms can ensure that their client data is secure when it is accessed remotely.

5. Foster Strong Client Relationships

During uncertain times, client loyalty and trust become even more critical. By focusing on building strong relationships with clients, CPA firms can provide them with the support they need to navigate through crises.

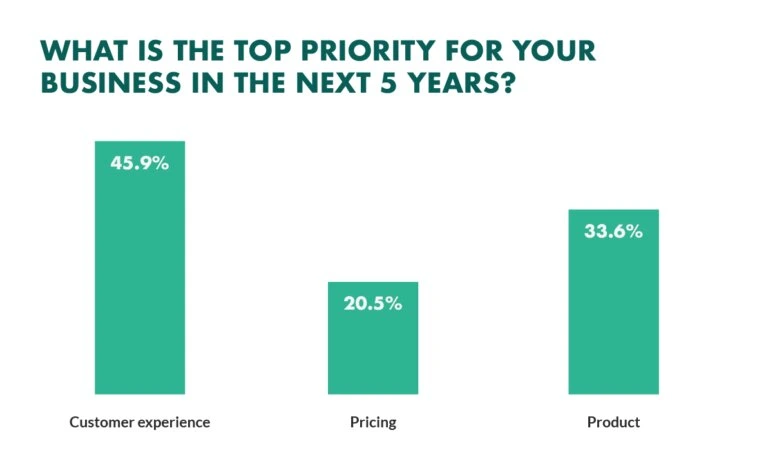

As per a survey by SuperOffice, when it comes to the first priority of business in the next 5 years, customer experience comes first. Beating product and pricing.

Here are some tips to foster strong client relationships:

- Provide exceptional service: This means going above and beyond to meet your clients’ requirements. It also means being responsive to their demands and providing them with timely and accurate information.

- Communicate effectively: Keep your clients informed about their accounts and any changes that may affect them. Be transparent about your charges and procedures.

- Be empathetic: Understand your clients’ challenges and listen to their concerns. Offer tailored solutions that address their specific needs.

- Be proactive: Don’t wait for your clients to come to you with problems. Be proactive in identifying potential issues and offering solutions.By following these tips, you can build a satisfied and loyal client base that will provide stability and ongoing support to your CPA firm.

6. Continual Professional Development

In today’s rapidly changing business landscape, continuous learning is essential. By encouraging your team to engage in professional development activities, attend industry conferences, and pursue relevant certifications, you can help them to stay up-to-date on the latest industry trends, regulatory changes, and technological advancements. This knowledge will equip your firm to adapt and thrive in any crisis situation.

Here are some specific tips for encouraging continual professional development among your team:

- Set a good example: As a leader, it is important to set a good example by taking the lead in professional development yourself. This will show your team that you value learning and that you are committed to their professional development.

- Provide learning opportunities: Offer your team opportunities to attend industry conferences, take online courses, or pursue relevant certifications. You can also create a culture of learning by providing resources and encouraging your team to learn on their own.

- Recognize and reward learning: When your team participates in professional development activities, be sure to recognize and reward their efforts. This will show them that you value their learning and that you are committed to their professional development.

7. Seek External Expertise

Sometimes, external expertise can provide valuable insights and guidance during crises. Consider partnering with a trusted business consultant or outsourcing certain functions to specialized firms. Outsourcing tasks can ensure operational efficiency and allow your team to focus on core business activities.

When you face a crisis, it can be helpful to seek external expertise. This can be done by partnering with a trusted business consultant or outsource accounting services to specialized firms.

There are several advantages of seeking external expertise during a crisis. First, it can provide you with valuable insights and guidance. A consultant or specialized firm may have experience in dealing with similar crises, and they can offer you advice on how to best manage your firm during this period.

Second, outsourcing certain services can free up your team to focus on core business activities. This can be especially helpful if your team is already stretched thin. By outsourcing tasks like bookkeeping, tax preparation, or audit services, you can ensure that these important functions are still being performed, while your team focuses on other priorities.

Building resilience is a proactive approach to safeguarding your CPA firm amid crises.

By conducting a risk assessment, diversifying your client portfolio, implementing robust business continuity plans, leveraging technology, fostering strong client relationships, investing in professional development, and seeking external expertise, you can effectively navigate through uncertainties and position your firm for long-term success.

Embrace resilience as a core value, and your CPA firm will emerge stronger and more prepared to face any challenges that come your way.